how to calculate nh property tax

Look up your property tax rate from the table. Your average tax rate is 1198 and your.

Cities With The Lowest Tax Rates Turbotax Tax Tips Videos

How to Calculate Your NH Property Tax Bill.

. Counties in New Hampshire collect an. The current 2021 real estate tax rate for the Town of Londonderry NH is 1838 per 1000 of your propertys assessed value. New Hampshire income tax rate.

The result is the tax bill for the year. The statute imposing the tax is found at RSA 78-B and NH Code of Administrative Rules Rev. Property tax bills in New Hampshire are determined using factors.

NH property tax rates are set in the Fall and are retroactive to April 1st of that same year. How to Calculate Your NH Property Tax Bill. Municipal reports prior to 2009 are available by request by calling the department at 603 230-5090.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Multiply the rate by 1000 and you get the property tax rate per 1000 of property value which is how the rate is usually stated. 0 5 tax on interest and dividends Median household income.

The assessed value of the property. The assessed value of your property minus any exemptions granted is your propertys taxable. The local tax rate where the property is.

To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions. Tax amount varies by county. To calculate the annual tax bill.

New Hampshire Real Estate Transfer Tax Calculator. All documents have been saved in Portable Document Format unless otherwise. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767.

The formula to calculate New Hampshire Property Taxes is Assessed Value x Property Tax Rate1000 New Hampshire Property Tax. By law the property tax bill must show the assessed value of. The RETT is a tax on the sale granting and transfer of real property or an interest in real property.

The formula to calculate New Hampshire Property Taxes is Assessed Value x Property Tax Rate1000 New Hampshire Property Tax. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our New Hampshire property tax records tool to get. Take the Assessed Value of the property then.

Taxes owed taxable assessment x property tax rate per thousand. New Hampshire Income Tax Calculator 2021. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price.

Census Bureau Number of cities that have local income taxes. The assessed value multiplied by the real estate. The assessed value 300000 is divided by 1000 since the tax rate is based on every 1000 of assessed.

The formula to calculate New Hampshire Property Taxes is Assessed Value x. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. New Hampshires tax year runs from April 1 through March 31.

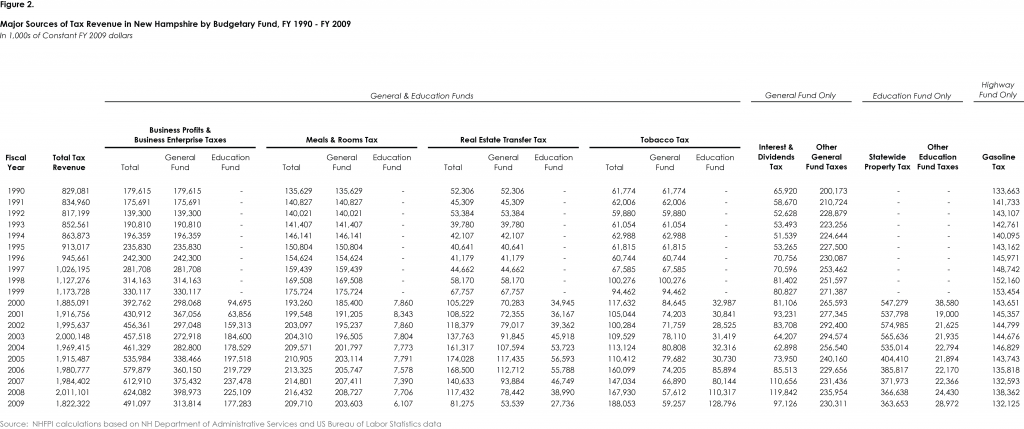

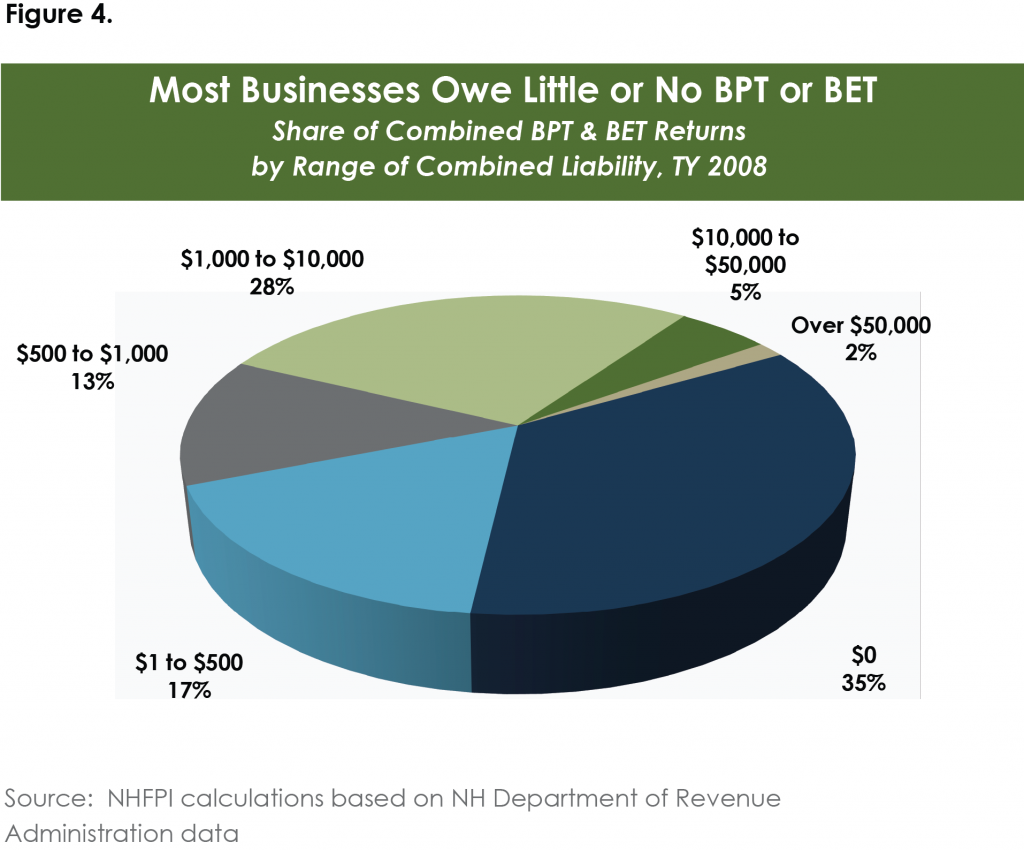

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Online Property Tax Calculator City Of Portsmouth

Held Back Why N H Still Struggles To Answer School Funding Questions New Hampshire Public Radio

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

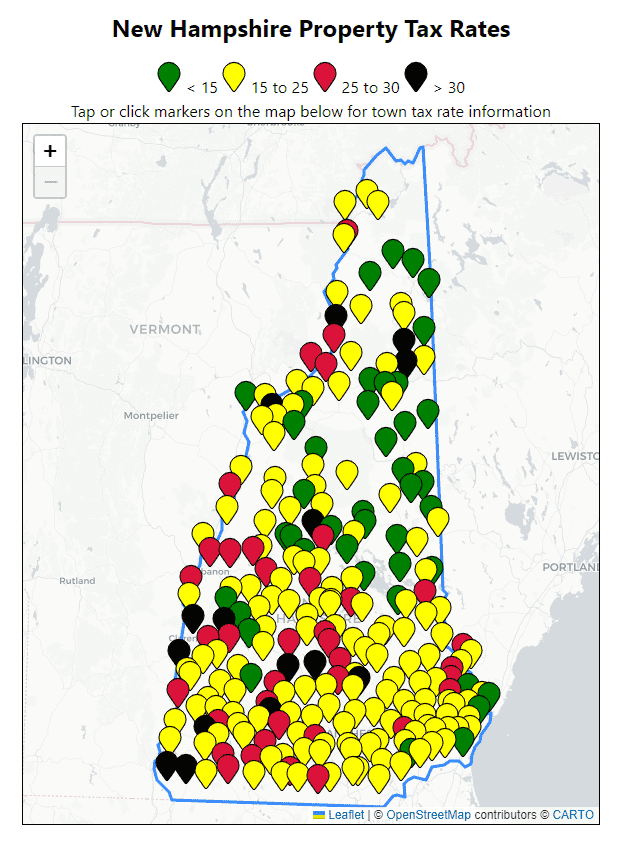

All Current New Hampshire Property Tax Rates And Estimated Home Values

New Hampshire Municipal Tax Rates How Are They Calculated Ppt Download

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

Dmv Fees By State Usa Manual Car Registration Calculator

Business Nh Magazine Nh Named A Most Tax Friendly State

2021 Tax Rate Set Hopkinton Nh

Monadnock Ledger Transcript Report School Funding Method Used Across N H Isn T Fair To Students Or Taxpayers

Understanding Property Taxes In New Hampshire Free State Project

All Current New Hampshire Property Tax Rates And Estimated Home Values

Deducting Property Taxes H R Block

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

State Education Property Tax Locally Raised Locally Kept

Dover Tax Bills Go Up 245 90 For Average Single Family Homeowners